Due to the poor 7nm yield, the agency said that the mass production of Intel Sapphire Rapids Xeon processors was delayed ; AMD will be the biggest beneficiary, and it is expected that the market share of x86 server processors will further increase in 2023, from 15 % in 2022 increased to 22%. A few days after Intel released the not-so-good Q3 quarterly financial report, AMD's Q3 financial report was also released!

Revenue was US$5.565 billion, an increase of 29% compared to US$4.313 billion in the same period last year, and it can grow against the trend in the current environment. AMD (NASDAQ: AMD) reported third-quarter 2022 revenue of $5.6 billion, gross margin of 42%, operating loss of $64 million, net income of $66 million, and diluted EPS of $0.04; another In terms of AMD Ryzen, it will launch 7000 series 3D models, which are expected to provide higher bandwidth than the previous generation.

1>

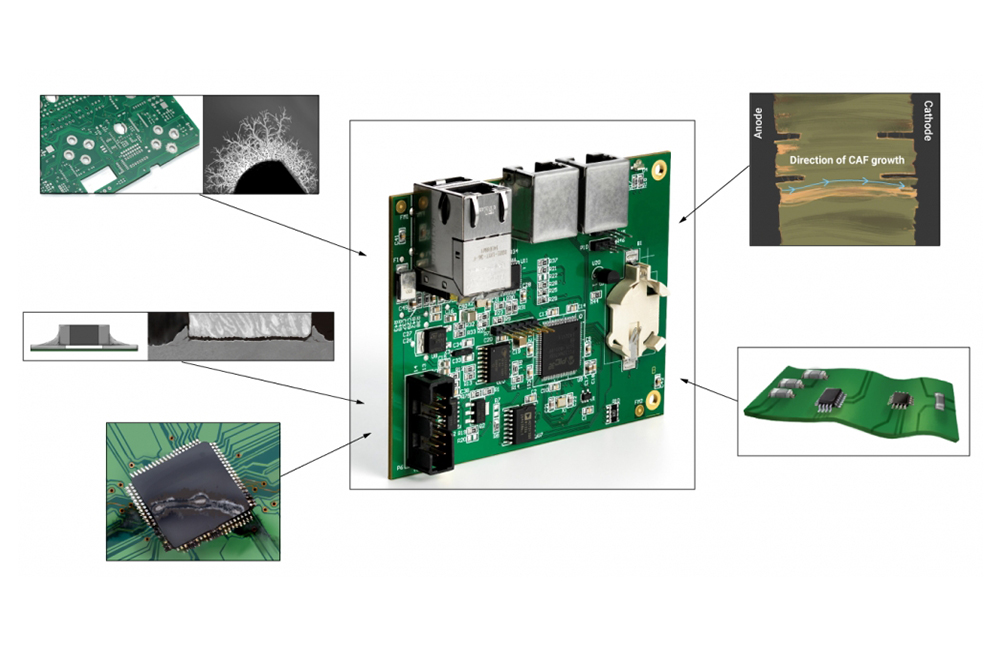

At the same time, Tesla also postponed mass production. It is said that Tesla plans to postpone the mass production date to the end of next year, and Cyberrock has skipped the ticket again! In the big environment of the Internet of Things and the digital era, many technologies such as sensors, chips, software are being built as "nuclear weapons" to expand and fight in the digital field. Intel and its partners together promote the innovation and application breakthrough of such turning technologies as chips, sensors, software, artificial intelligence, 5G, intelligent edge, and drive the intelligent connected world. The intelligent industry that should have been developing well suffered from the crisis of poor 7nm yield; And Tesla, an American electric vehicle and energy company with a market value of 210 billion dollars , which produces and sells electric vehicles, solar panels, and energy storage equipment, can it perfectly implement the plan of postponing mass production?

2>

In addition, some organizations pointed out that the situation of the production of Apple's mobile phones was also not optimistic. The sales of the iPhone 14 Pro series still failed to compete with the high inflation. The production of Apple's mobile phones in the first quarter of next year has been reduced to 52 million. In the second quarter, the quarterly growth of the output value of the top ten foundry wafers converged to 3.9%. The postponement and reduction of mass production meant that the market reaction was cold and inventory accumulation was difficult to eliminate. In order to reduce inventory, suppliers bid to expand the decline. It is estimated that the price of NAND Flash products in the fourth quarter will decline by 15-20%. The output of Apple and Intel will show a downward trend in different ways. However, the hope of the market is to continue to observe the customized chip business of Sony PS and Microsoft Xbox. It is reported that such business has a bright prospect, which may inspire the mass production of Intel and Apple.