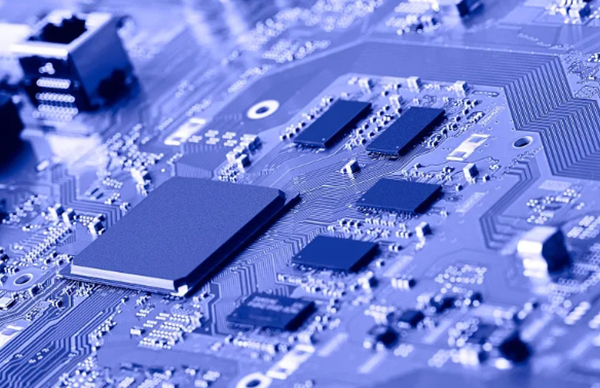

I Detailed information shows that DISCO is a Japanese company whose core competitiveness is to grind the manufactured semiconductor silicon wafers into thinner silicon wafers, then cut them into dies, and then assemble them into electronic products. As a wafer cutting equipment factory, DISCO has recently invested 2.06 billion yuan and plans to expand production by 40%. The main reason for its full production capacity and sharp increase in performance is: customer investment, that is, the demand is very strong.

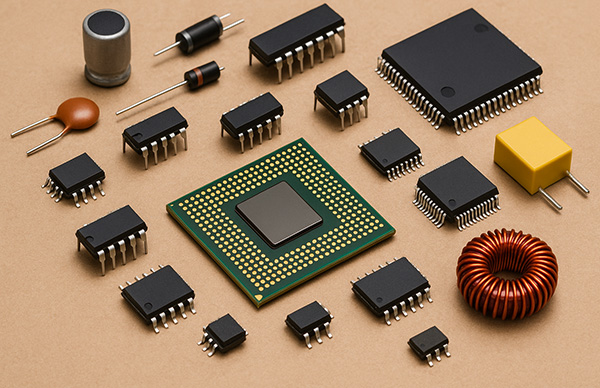

II Wafer refers to the silicon chip used in the production of silicon semiconductor integrated circuits. Because of its circular shape, it is called a wafer. In fact, as early as 2021, the expansion of production led to a hot investment in equipment, and the shipment of DISCO, a major wafer cutting machine manufacturer, reached a new high in the quarter at that time.

III According to the comments of professionals on the semiconductor equipment industry, it is known that global equipment has received orders for semiconductor wafer laser slotting equipment, and the development of the packaging and testing process has accelerated. In addition, an in-depth analysis of the semiconductor material industry shows that: the expansion of fabs is driving the demand for materials, and the replacement of silicon wafers is at the right time; behind the continuous heating up of the semiconductor equipment market is the accelerated landing of global laser cutting equipment. The reason why wafer equipment can win orders from many leading packaging and testing factories and its performance has exploded year after year is closely related to the smallest market value of semiconductor equipment. The seemingly ordinary wafer is the top priority of semiconductor circuits. However, according to the forecast of the research institute TrendForce, the output value of wafer foundry in 2023 will decrease by about 4% year-on-year.

· In addition to the DISCO equipment factory, the price of 140,000 pieces of TSMC 3nm process wafers has doubled, and Apple has become the most steadfast customer. With the quotation of wafers exceeding 20,000 US dollars, it is expected that Apple may monopolize TSMC's 3nm production capacity this year. According to the summary, TSMC's 7nm and more advanced processes accounted for 54% of total wafer revenue in the fourth quarter of 2022!

· TSMC is also considering building another fab in Japan, and is evaluating building a fab for cars in Europe!

· In order to quickly catch up with TSMC, Rapidus, a Japanese wafer foundry company, will trial-produce a 2nm process in 2025.

· Manufacturers such as Samsung and SK Hynix plan to reduce the purchase of silicon wafers. In order to follow the pace of TSMC, Samsung Electronics may reduce foundry expenses this year and maintain its medium- and long-term expansion of investment stance.

· The chairman of PSMC also confirmed that he will assist India to build a fab locally!

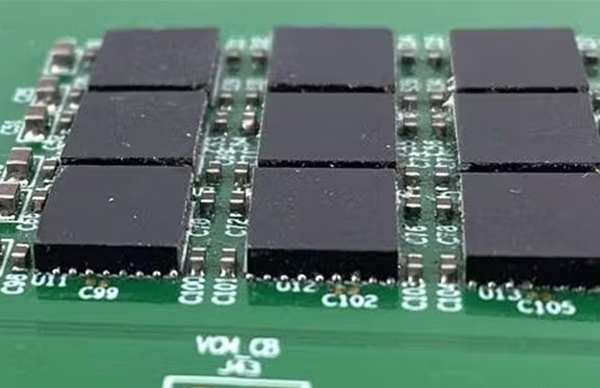

IV It is reported that generative design and additive manufacturing have also redefined the thermal management performance of the chip lithography machine wafer table. The production capacity of MEMS packaging and testing lines of some enterprises is 10,000 wafers/month.